I personally use Apex Trader Funding at they list out all information on their site.

#TRAILING MAX DRAWDOWN FREE#

If you are still confused on it, feel free to do some more research. The trailing drawdown is a key component to be aware of at all times.

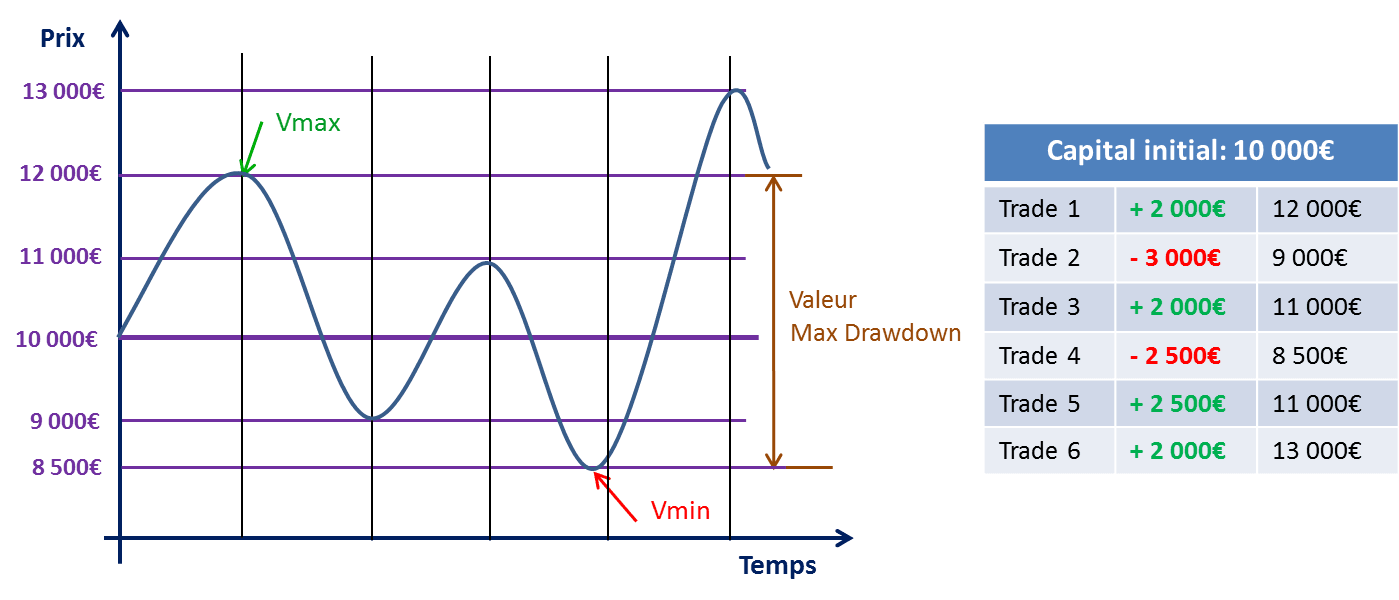

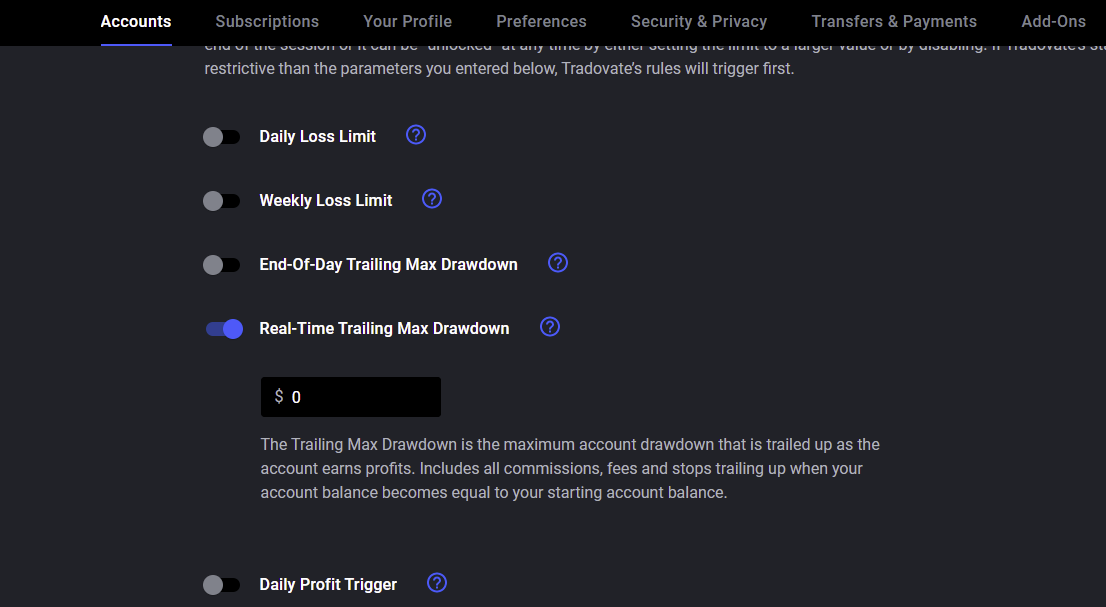

Your trailing drawdown is now $1,500, even though your balance is the same. Since you closed your position at breakeven, Your balance is $50,000 still. Since your trailing drawdown follows your open P/L (for most prop firm challenges), This means your trailing drawdown is now $48,500. However, it pulls back to breakeven and you exit. On your first trade, your position goes up by $1000. Your trailing drawdown is $47,500, meaning if you lose $2,500, you fail. This number trails, meaning it follows your account balance.Įxample. Trailing Drawdown - This is your stop loss level, that when hit, causes you to fail your evaluation account. Not only do you have a set profit goal, but you have a trailing drawdown that you must avoid: This is one of the most important rules you must be aware of when attempting a prop firm evaluation account. It's a win-win in my book, and after analyzing all of the pros and cons it just made sense. I do not have to split my capital for this, and instead and use all of my own capital for these longer term trades and focus on scalping futures using my funded accounts. I believe heavily in the importance of trading mindset and reducing psychological stress, and this is one way to do so.Īlso, I now use my personally funded account for longer term trades and swing trades when I see the proper setups. I am willing to give up 10% of my profits for the ability to maintain a calm and collective state of mind while trading. So why do I use a funded trader program? As listed in the pros section, it has given me the ability to size up my trades and not risk more of my own capital. Helps you avoid undisciplined actions.įor pros and cons, just flip the two sections and it should make sense. For those learning, having set rules can reduce your chances of making mistakes. Gives you the ability to size up your trades without actually risking more of your own capital, which can be a huge psychological barrier for most. Reduces the mental stress of sizing up.If you are in the learning process, this eliminates your ability to "blow up" your own funds. Risking only a small portion of your own capital, whatever the sign up fee is for the evaluation account.No restrictions on trading size, when you can trade, etc.)

#TRAILING MAX DRAWDOWN PRO#

No enforced trading rules (Can be a pro or con to some.No trailing drawdowns (Will discuss what this is in the upcoming section).Can use any broker you want that supports the market you want to trade.No waiting period to pass an evaluation account.Here are my pros and cons to trading both your own capital and receiving funding from a prop firm: Own Capital - Pros So with this very brief an undetailed process being laid out, you can start to see some possible benefits and/or downsides to it. Most prop firms I've seen allow you to keep 80% to 90% of all profits you make. Trade, and keep the majority of your profits.

#TRAILING MAX DRAWDOWN UPGRADE#

If you hit the profit goal, you will then be given the option to upgrade to a performance account - AKA an account in which you can actually trade to make money.If you hit the drawdown, you must restart the evaluation process from day 1, and have to pay the evaluation fee.You are given a profit goal to hit and a drawdown to avoid. If you aren't familiar with funded trader programs, here's the breakdown:

If you choose to use a funded trader program, be sure to read all of their own rules and guidelines on their site prior to starting. I can only truly speak for one of the funded trading programs out there since that's all I have personally used, however I know they are all pretty similar in rules and guidelines. There are pros and cons to both scenarios - trading your own capital and utilizing a funded trader program - which I will break down for you here shortly. Prior to this, I was trading my own capital - and I still do. Straight to the point, I have received funding from a prop firm by completing multiple evaluation accounts, and have been trading them for quite some time now. In this post, I will break down one of the greatest challenges with prop firm evaluations - the trailing drawdown - and offer some tips for success on your funded trader journey. However, with that comes additional challenges that traders need to find a way to navigate. The barrier to entry is low, given you only need to pay a small evaluation fee to get started. Over the past few months, funded trader programs have grown in popularity and have shown to be an alternative way for traders to launch their trading career.

0 kommentar(er)

0 kommentar(er)